Service charges

If you receive any service to any part of your property, you will have to pay service charges. Your lease will set out your service charge obligations in terms of what you must pay for and whether the service charges are fixed or variable.

- Fixed service charges are based on the service offered. Customers with fixed service charges will only receive an estimate each year.

- Variable service charges are changed according to the actual costs.

You must pay your service charge, as well as the rent.

You may be charged a service charge for some, or all, of the following:

Communal area cleaning

This is a charge for any internal communal area cleaning the landlord is required to provide, typically within apartment blocks with shared communal areas.

Ground maintenance

This is for the maintenance of any external communal areas, grassed or otherwise, that the landlord is responsible for.

Building insurance

This covers the cost of insuring your home (buildings insurance only). This charge will not apply if you own your own home 100% and have become a freeholder.

Management charge: This is a contribution to our costs in managing the estate and the cost of services to leaseholders. This could include:

- Allowing you quiet enjoyment of your home

- Local housing management, inspections, repairs and dealing with nuisance

- Meetings with residents

- Maintaining records of leaseholders

- Calculating estimated service charges

- Billing service charges and ground rent

- Collecting payments

- Arranging buildings insurance and making claims for the structure and communal areas.

- Providing newsletters and handbooks

- Responding to enquiries

Procurement of services

The services delivered to you are carried out either the landlord or by a contractor on our behalf. Before we employ contractors to work on our behalf, we carry out a competitive tendering process. This involves comparing the quality and cost of delivering services and consulting residents. For more information on resident consultation please see the Section 20 page.

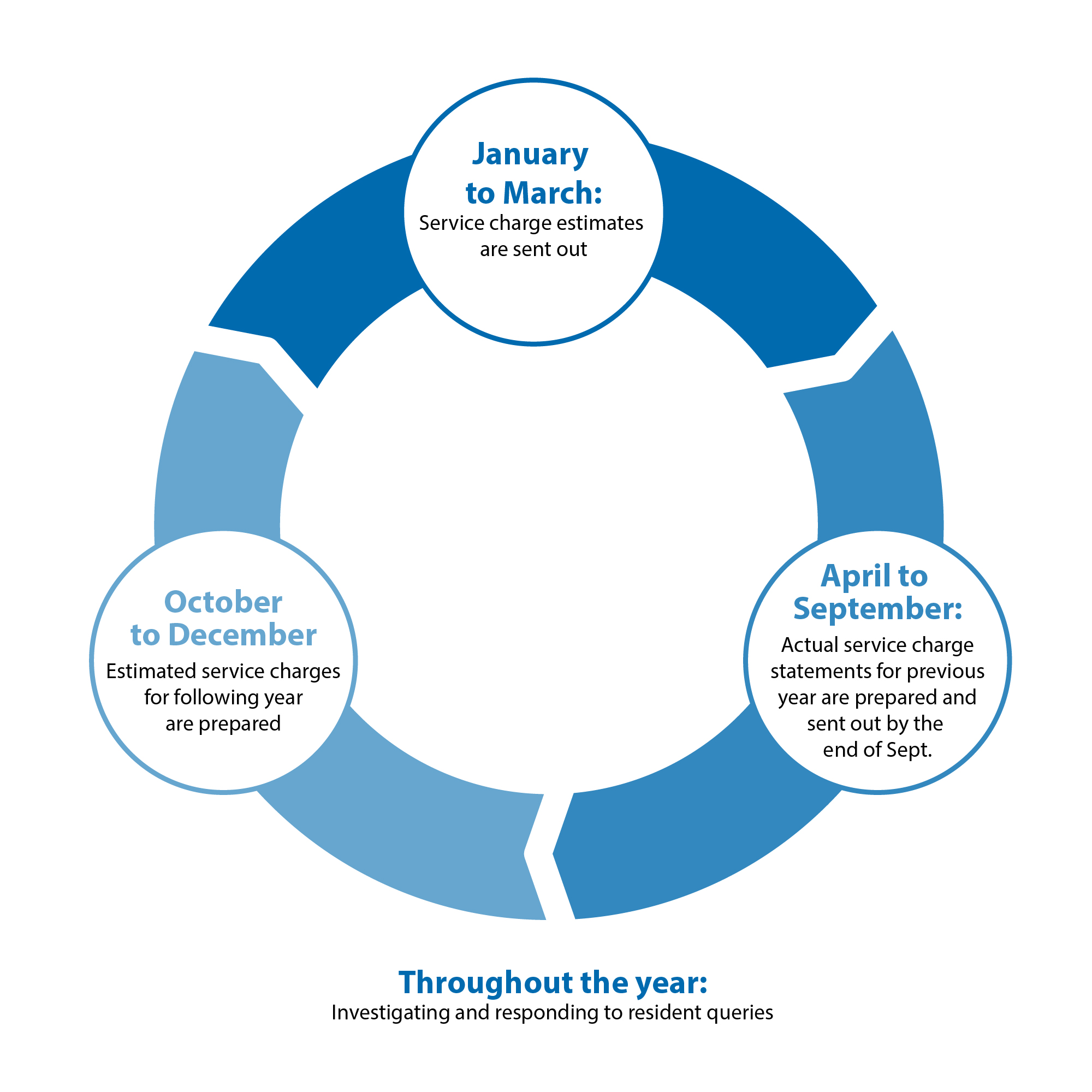

The service charge year

The service charge year is a financial year which runs from 1 April to 31 March. We will send you a proposed scheme budget for the expected costs during the coming financial year in around February/March of each year. This budget estimates the amount of money we will need for the following year and sets out how much service charge you will pay.

Within six months of the end of March (by 30 September) we will send you a statement of the service charge accounts for your scheme for the previous year.

Estimated service charges

Before the beginning of each financial year, we estimate the costs for providing works and services to your building and communal areas (if applicable) during the coming year. Whilst some contract values are fixed, other costs are variable. For example, we don’t not know how much we might spend on bulk rubbish removal. Therefore, we ask you to pay an estimated charge throughout the year. We base the estimates on costs in previous years, plus an amount for inflation. We will then send you details of the contribution you have to pay before the end of March each year.

Actual service charges

These are calculated once the financial year has ended. We use records, invoices and information about services to work out how much was spent on your building and communal areas (if applicable). Within six months of the end of the financial year, our accounts are audited by independent auditors and a statement of actual expenditure is produced. This statement is sent to customers with variable charges by the 30 September each year.

The statement will include details of the actual costs and tell you the difference between the actual cost and the estimated charges we sent you at the start of the financial year. We will put the difference onto your service charge account. If there is an additional charge, you should pay it when you receive the details.

For customers on fixed service charges, we can only charge what we budgeted, so you will not receive a statement. If you see an increase in your service charges the following year, it is likely that we spent more than anticipated during the previous year and have increased our budget accordingly.

Management companies

Some estates are not managed by Homes Plus but are instead managed by a private management company. Details of the management company service charge budgets and administration costs will be issued at sale where relevant.

Sinking funds

To try and avoid unexpected and expensive bills being charged to leaseholders, many lease agreements for leasehold properties include the requirement for the landlord to collect a contribution from leaseholders at the scheme. The contribution collected is used to build up a pot of money to fund major repairs, renewals and replacements at the scheme. This fund is sometimes referred to as a sinking fund, long-term maintenance fund or reserve fund.

A sinking fund ensures that the cost of major repairs and replacements is paid for fairly by all generations of leaseholders who benefit from them. A sinking fund also helps maintain the value of your property, and potential buyers’ solicitors will enquire about monies in the sinking fund. It is in all leaseholders’ interests that enough money is set aside to cover the cost of future repairs and renewals.

When do I pay?

The sinking fund collected for each scheme is used solely for work at that scheme. We do not pool together all the sinking funds we collect from different schemes and then use these to fund work at other schemes.

Where a sinking fund contribution is required, the method of collecting contributions to the sinking fund will vary according to the terms of the lease. In most cases the lease may state that the landlord will collect a sinking fund contribution from leaseholders at the schemes as an annual charge. In this case, the contribution is normally included in the service charge contribution.

In other cases, the contribution to the sinking fund is collected when a leaseholder re-sells the property. The amount to pay is defined by the terms of your lease agreement. Your solicitor should have informed you of any liability to pay when you purchased your property.

As the method of collection and the amount paid into the sinking fund varies from scheme to scheme depending on the terms of the lease, please check your lease for further information about this. Alternatively, please contact the leasehold officer for your scheme who will be able to check the terms of your lease agreement and clarify this for you.

What is the sinking fund money used for?

The money collected into the sinking fund for each block/scheme is used to pay for major works such as a new roof, or replacement lift, and external and internal decorations required at the scheme. In most cases a full consultation will take place prior to major work being ordered in line with the requirements of the Commonhold and Leasehold Reform Act 2002.

Depending on your lease and property, the sinking fund is used to pay towards major repairs or replacing such things as:

- External doors, windows, roofs, guttering, walls

- External drains and plumbing systems

- Footpaths, parking areas, fencing, signboards

- Communal electrical systems, TV aerials and lighting

- Door entry phone systems

- Communal carpets

The lease will set out the arrangements for this as well as when regular, cyclical, maintenance works are due. If there is insufficient money in the sinking fund to deal with major works, the costs will be shared between owners in the proportions set out in the individual leases.

The money in the sinking fund is held in trust on your scheme’s behalf, in an interest-bearing bank account. Homes Plus does not receive any benefit or retain any money from the sinking fund. We manage this money on behalf of residents. Contributions to the sinking fund are not repayable to you when the flat is sold.

Ground rent

Ground rent is a payment made by the leaseholder to the freeholder under the terms of your lease. We will send you a ground rent demand and an invoice for your ground rent contributions in accordance with the terms of your lease each year.

Falling into arrears with your rent, service charges or ground rent

Under the terms of the lease, it is the leaseholder’s obligation to pay service charges and ground rent promptly. Without regular and prompt payments from leaseholders, your landlord may not be able to provide services and carry out our obligations as a landlord.

If you get into rent or service charge arrears it is important that you discuss with us how you will pay the debt. You have a dedicated officer responsible for dealing with your account, please use the contact us form to get in touch. We also have a dedicated money advice team that is here to help, please contact our customer service Centre for further details.

We will monitor your payments and we will begin immediate action if amounts are not paid regularly or in full. If you do not, we will take action to get the debt paid – this could mean contacting your mortgage lender to ask them to pay off your arrears. If they do this, they will add your service charge/rent debt to your mortgage and you will end up paying a lot of interest on it.

We will take legal action against you if you fail to clear your arrears and if approved by a court, this can lead to the landlord repossessing your property.

Your home, and the equity you have invested into it, may be at risk if you do not keep up with your rent and service charge payments. Therefore, if you start to get into difficulties, please talk to us straight away so we can agree a plan of action.